Diversify Investments – Reduce Portfolio Risk Today!

When it comes to building long-term wealth, mastering diversification of investments is one of the smartest strategies you can observe. In today’s unstable markets, certainly placing all your money into one stock or asset class can spell disaster. Whether you are new to making an investment or reevaluating your present-day strategy, understanding how to diversify your portfolio USA and following clever diversification tips in 2025 is critical to your financial success.

In this complete manual, we’ll discover what diversification surely way, how to spread investments across different asset classes, and how the right portfolio hazard management US can defend you for the duration of uncertain times. From asset allocation beginner strategies to superior procedures, we’ve got your funding roadmap protected.

Why You Need to Diversify Investments

Investing is all about balancing risk and reward. Putting all of your capital into one funding source exposes you to an extra risk of loss. Diversify investments by allocating your capital across a mixture of asset types to ensure that poor overall performance in one doesn’t wipe out your entire portfolio.

Benefits of Diversification:

- Reduces portfolio volatility

- Protects towards market downturns

- Maximises long-term returns

- Helps align hazards with funding goals

Many new investors ask the ways to diversify a portfolio USA in sensible ways. The answer starts with asset allocation—the muse of all nicely diversified portfolios.

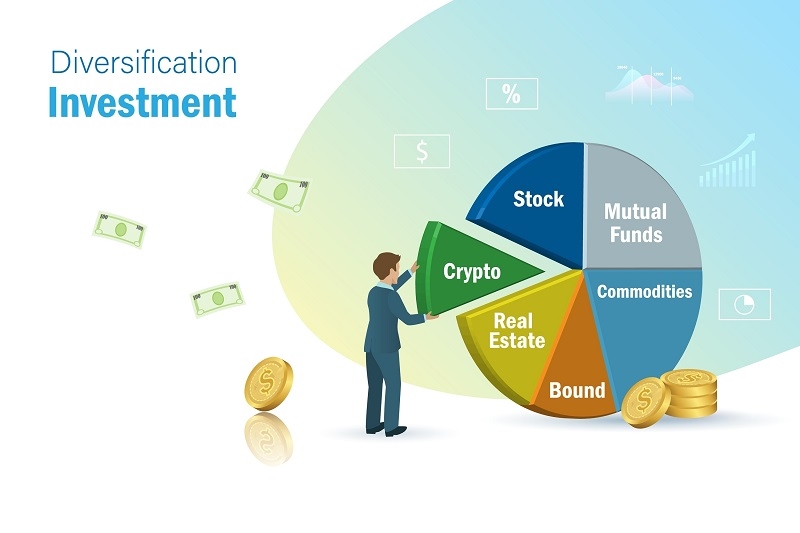

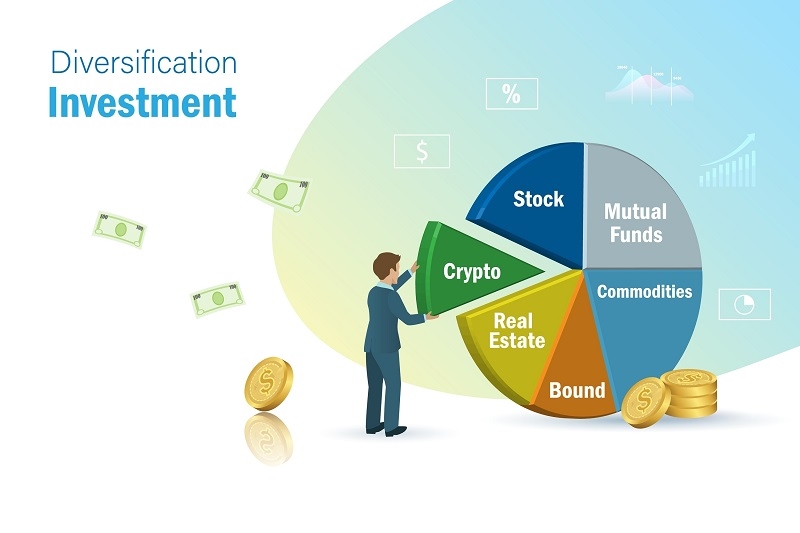

Understanding Asset Allocation: Beginner Strategies

Let's talk about asset allocation and beginner-friendly tips. Asset allocation is the process by which you divide your investments across specific categories, such as stocks, bonds, coins, and real estate. More important than looking for the most aesthetically pleasing home is choosing the appropriate aggregate depending on your preferences, time horizon, and threat tolerance.

Common Asset Classes to Include:

- Stocks: Increased boom capability and improved risk

- Bonds: A time of equilibrium and profits

- Equivalents of cash or coins: Use and liquidity in an emergency

- Real estate: Long-term income and inflation protection from real estate

- Commodities: With market changes, commodities are a potent hedge against competition.

- Alternative investments: Private equity, bitcoin, hedge funds, and many more are examples of alternative investments.

More asset allocation novices begin by means of choosing a ratio like 60% stocks and 40% bonds and rebalancing regularly. This maintains your funding aligned with your monetary goals while addressing portfolio risk control and US needs.

How to Diversify a Portfolio USA Using Modern Tools

In the U.S., traders have get right of entry to a huge range of equipment and tools that make portfolio diversification simpler than ever.

Use These Tools to Your Advantage:

- 401(okay) and IRAs – Tax-advantaged retirement debts that allow funding in mutual funds, ETFs, and more.

- ETFs (Exchange-Traded Funds) – Low-priced funds that offer exposure to loads of securities in one buy.

- Robo-Advisors – Automated offerings that construct varied portfolios through the use of state-of-the-art algorithms.

- Brokerage Accounts – Full manipulation of where and how you invest with access to stocks, bonds, crypto, and more.

The key to learning how to diversify a portfolio USA is consistency and a goal. Don’t just randomly purchase assets—compare how each contributes to lowering risk and increasing possibility.

Diversification Tips 2025 for Smarter Investing

As we appear closer to 2025 and beyond, here are some forward-looking diversification tips 2025 to assist in defending and developing your wealth.

- Balance Growth and Safety: In a high-hobby environment or volatile market, blend increased shares with more secure property like dividend-paying equities and bonds.

- Invest Globally: International markets provide exposure to specific monetary cycles. Invest in global ETFs or funds to diversify beyond the U.S. Marketplace.

- Incorporate Real Assets: Real estate, commodities, and infrastructure finance add balance in the course of inflationary periods.

- Use Dollar-Cost Averaging: Instead of timing the market, make investments of a set quantity often. This strategy enables the reduction of emotional decision-making and market timing errors.

- Monitor Correlations: Choose investments that don’t move in the same direction. For instance, bonds frequently rise when shares fall. This inverse correlation enables the reduction of volatility.

Implementing those diversification guidelines in 2025 will preserve your method sparkling and future-proof.

Portfolio Risk Management US Strategies You Should Know

Risk is unavoidable in investing, but that doesn’t mean you can’t manipulate it effectively. Good portfolio risk management US involves making ready for downturns, not just chasing returns.

Top Risk Management Strategies:

- Rebalancing – Adjust asset allocation yearly or quarterly to live aligned with your desires.

- Risk Profiling – Regularly investigate your risk tolerance and update your strategy.

- Hedging – Use alternatives, bonds, or gold to hedge against the most important market activities.

- Diversify Investments – Never rely on one employer, enterprise, or location.

- Emergency Fund – Keep 3–6 months of expenses in cash to avoid promoting investments at a loss.

Your method of portfolio hazard management US must evolve as your income, lifestyle, degree, and economic dreams change.

Mistakes to Avoid When You Diversify Investments

While the concept of diversification is simple, it’s easy to make mistakes that hurt instead of help.

Common Pitfalls:

- Over-Diversification: Spreading too thin throughout too many investments can cause dilution of returns.

- Underestimating Correlation: Owning multiple tech stocks might seem diverse, but they’re all laid low with identical trends.

- Ignoring Rebalancing: If one asset's magnificence outperforms, your unique stability is skewed. Always reset for your preferred allocation.

- Neglecting Fees: High charges on actively managed funds can eat into your returns. Look for low-cost ETFs or an index budget as an alternative.

To definitely diversify investments efficaciously, remember excellent correlation and fee, not just amount.

Example Scenarios: How to Diversify Based on Life Stage

1. Young Professional (25–35 Years Old)

- Goal: Consistent growth

- Allocation: 10% bonds, 10% cash, and 80% stocks make up the allocation.

- Tools: Roth IRA, 401(ok), and ETFs

- Focus: Invest aggressively and maximise returns.

2. Investors in their mid-career (36–50 years old)

- The goal is stability and increased stability.

- The allocation is composed of 60% stocks, 30% bonds, and 10% alternatives.

- Tools: A brokerage account and several mutual funds

- Focus: Save money and purchase items for future goals.

3. Pre-Retiree (those in the 51–65 age range)

- Goal: Preserving capital

- Allocation: 10% REITs, 10% coins, 40% stocks, and 40% bonds make up the allocation.

- Tools: IRA rollover, annuities, and CDs

- Focus: Lower risks and increase income

For better consequences, alter your beginner asset allocation approach according to your degree of lifestyle.

Frequently Asked Questions

Is diversification enough to guard in opposition to a market crash?

- Not absolutely, but it considerably reduces the effect by means of restricting exposure to anybody's assets.

Should I diversify inside every asset class?

- Yes. Own a combination of U.S. and international shares, long- and short-term bonds, and diverse sectors.

How frequently do I have to assess my portfolio?

- At least once a year, or anytime you experience the most important life adjustments (job, marriage, children, and many others).

Are robo-advisors accurate for diversification?

- Absolutely. They offer low-fee, mechanically varied portfolios ideal for novices and time-strapped buyers.

By committing to smart diversification, you build lengthy-time period resilience into your financial life.

Final Thoughts on How to Diversify Investments Effectively

One of the maximum critical strategies for long-term economic safety is diversifying your investments. By the way, you could lessen your exposure to market volatility and economic fluctuations with the aid of diversifying your portfolio in the United States. For novices, distributing investments throughout the property, including equities, bonds, real property, and mutual funds, is an effective asset allocation approach. This approach not only increases your chances of regular returns through the years, but it also balances risk. You may keep away from overconcentration in someone's asset class and adapt to marketplace tendencies with the aid of the use of sensible diversification recommendations for 2025.

Whether you are simply starting or fine-tuning your financial approach, consider unfolding investments across assets to build resilience. Strong portfolio hazard management inside the U.S. isn’t about fending off hazards altogether — it is approximately coping with them wisely. Start today to diversify investments and stabilise your monetary destiny with confidence.

This content was created by AI